RTX Corporation: A Deep Dive into Its Advancements in Radar Technology

As geopolitical tensions escalate and global defense spending rises, RTX Corporation is stepping up to the plate. Known for its innovative solutions, the company is focusing on enhancing its radar systems portfolio, which is critical for surveillance, missile detection, and air defense.

Within RTX, the Raytheon segment has made a name for itself in developing next-generation radar systems that bolster tracking precision and situational awareness, serving both land and naval operations. In response to the growing need for advanced military radar solutions, RTX has committed substantial resources to research and development, seeking to capture a larger share of the military radar market.

A remarkable milestone in this journey was the successful first flight test of RTX’s PhantomStrike radar in May 2025. This cutting-edge, fully air-cooled radar leverages gallium nitride (GaN) technology, achieving long-range threat detection at about half the cost of traditional fire-control radars. Shortly thereafter, in September, RTX unveiled the APG-82(V)X, the latest iteration of its renowned APG-82 combat radar. This advancement incorporates state-of-the-art GaN technology, significantly enhancing the radar’s efficacy in air-to-air, air-to-ground, and electronic warfare operations.

Such technological innovations are expected to bolster Raytheon’s sales figures in the years to come, which saw a commendable growth of 6.4% in the second quarter of 2025.

Key Players in the Growing Radar Market

The global radar systems market is on an upward trajectory as nations ramp up investments in surveillance, air defense, and missile detection technologies. RTX isn’t the only company poised to benefit from this demand; major defense contractors like

Kratos Defense & Security Solutions, Inc.

and

Lockheed Martin Corp.

are equally well-positioned to capitalize on the expanding market.

Kratos has developed a radar portfolio that includes advanced hardware and subsystems for ground-based radar applications. Their recent achievement includes securing a U.S. Navy contract worth up to $175 million under Project Anaconda, aimed at developing an organic sustainment capability for the AN/SPY-1 radar systems. This contract underscores Kratos’ stature as a significant radar manufacturer within the defense sector.

Lockheed Martin’s radar systems boast usage by over 45 nations across six continents. Their comprehensive portfolio features radars such as TPY-4, AN/APY-9, and AN/TPQ-53, among others. Notably, in July 2025, Lockheed delivered the first Aegis System Equipped Vessel shipset, which included four AN/SPY-7(V)1 radar antennas, to the Japan Ministry of Defense, showcasing their strong foothold in international defense partnerships.

The Zacks Rundown for RTX

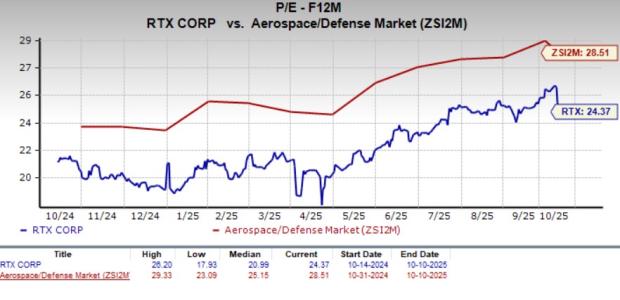

In the past year, shares of RTX have surged by 27.3%, outpacing the industry’s average growth of 15.8%. This robust performance is indicative of RTX’s strong position in the market and the increasing investor confidence in the company’s strategic direction.

Interestingly, RTX shares are trading at a relative discount, with a forward 12-month Price/Earnings ratio of 24.37X, compared to the industry’s average of 28.51X. This suggests potential upside for investors looking to enter the market at a reasonable price point.

Over the past 60 days, the Zacks Consensus Estimate for RTX’s near-term earnings has remained stable, indicating confidence in the company’s ongoing performance. Currently, RTX stock carries a Zacks Rank #3 (Hold), reflecting a balanced outlook on its future.

For those interested, you can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research